9 Free Ways to Increase Arizona Home Ownership

What Arizona can do to help stabilize house prices, which would increase Arizona home ownership, family wealth, and economic growth, all for FREE.

It’s true that getting building permits is a huge pain in the neck and the process can be improved, but it’s a myth that zoning is what caused house prices to skyrocket during Covid.

More supply would be great but, in fact, the U.S. has never had more housing per person.

Whenever you read that the U.S. housing supply is short X million homes, check their math. They don’t look at the number of homes and the number of people. Instead, they use convoluted calculations based on vacancy rates to get those crazy high housing shortage numbers.

Pace vs. Price

Builders already have enough approved building permits to build a ton more houses… when they want to.

Even though they have the building permits, builders, naturally, don’t want to build houses at such a fast pace that they would have to lower their prices, profits, and executive bonuses to sell them all.

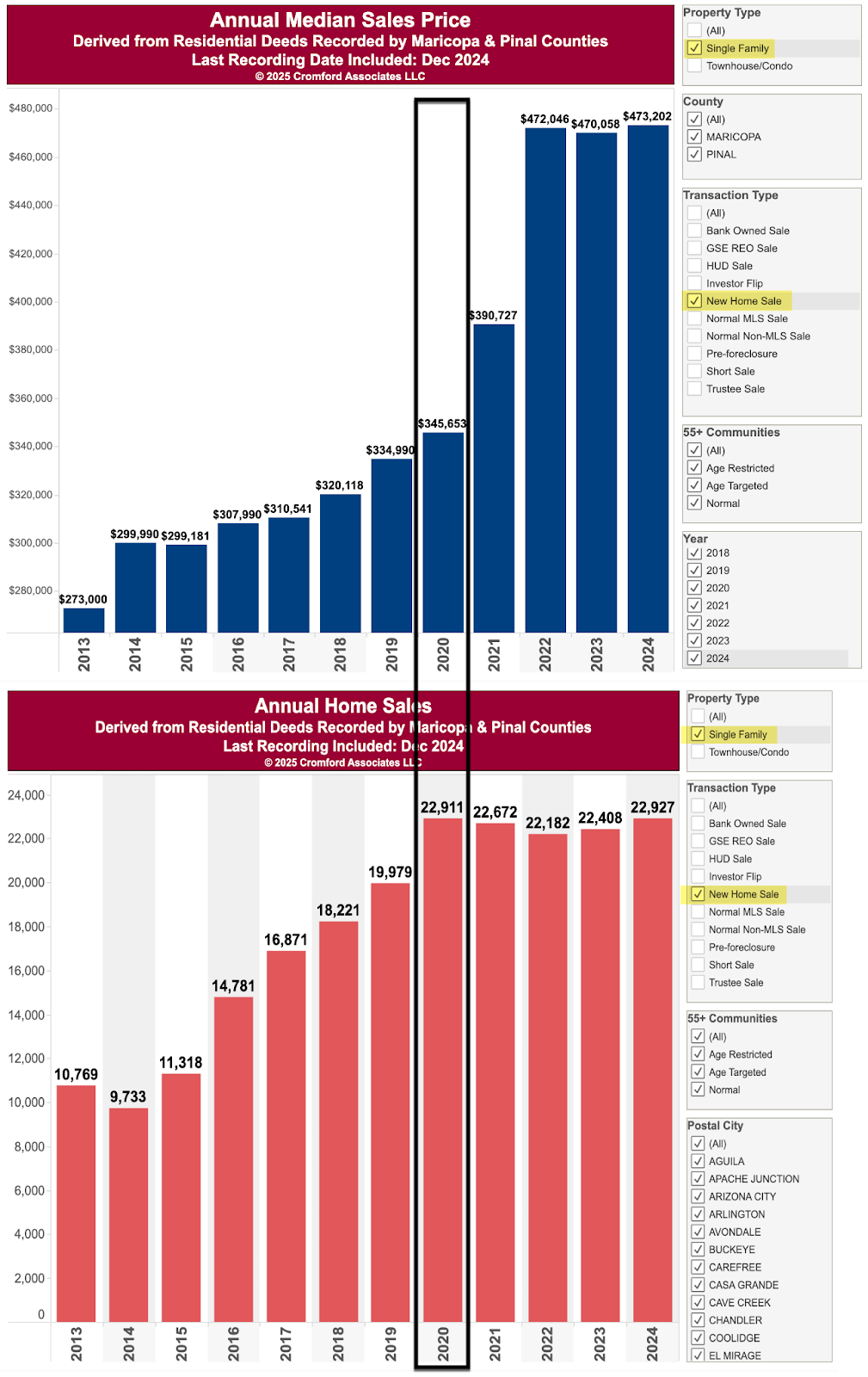

For example, even though the median sold price of new single-family homes in metro Phoenix increased from $346,000 in 2020 to $472,000 in 2022, builders sold FEWER new homes in 2022 than in 2020! The median price was $126,000 higher in 2022, but the number of new homes sold didn’t increase at all. To sell more houses in 2022, builders would have had to lower their prices and profits, and, rationally, they chose not to.

Was it caused by temporary Covid supply chain problems? No.

Two years later, in 2024, the median price was still $128,000 more than in 2020 but builders still sold the same number of new single-family homes in metro Phoenix in 2024 as in 2020.

Clearly, builders don’t want to lower their prices. They would sell homes faster at lower prices but their total profits from the subdivision would be less. That would be irrational.

The Supply Myth

The idea that house prices skyrocketed during Covid because of building codes and zoning is a myth promoted by real estate developers, builders, and land investors for two reasons:

To pressure governments to upzone their land because upzoning increases the value of their land.

To direct public and policy-maker attention away from a free solution the real estate industry does NOT want – reducing government-created investor demand.

Tax breaks and other government incentives for landlords of single-family homes and condos increase investor demand and make real estate booms and busts a lot worse because investors can jump in and out of the market a lot more easily than home owners who live in their homes. In addition, when investors jump in during booms, many buy multiple homes. Live-in home buyers only buy one.

Upzoning Does NOT Make Homes More Affordable

A large Urban Institute study found the supply of homes increased by less than 1% after deregulating zoning, and the supply of lower-cost homes did not increase at all. Most studies come to the same conclusion – upzoning does not make homes more affordable.

Upzoning increases the density of new homes built, not the number of new homes built.

The Real Reason Why Home Prices Skyrocketed

Let's compare the sales of existing (not new) single-family homes sold via the Phoenix area MLS in the boom year 2021 – when the median sold price increased by $85,000 in one year – to the pre-boom year 2019.

In 2021, investors bought 6,800 more homes than in 2019.

In 2021, live-in home owners bought 2,900 FEWER homes than in 2019.

Live-in home buyers did NOT cause house prices to skyrocket in 2021. Investor buyers did.

(Data points derived from the “intended use” buyers give when deeds are recorded in Maricopa and Pinal counties of normal MLS single-family home sales that were compiled and published by The Cromford Report.)

The Total Supply of Homes, Naturally, Increases Extremely Slowly

According to Census data, the total supply of all housing units in the U.S. increased an average of 1% a year from 2002 to 2023 and the largest 1-year increase was 1.6% in 2005 at the peak of the housing boom.

Homes are by far the biggest and most expensive thing people buy in their lifetimes so, naturally, houses also take the longest to make.

Homes aren't built in a factory, they're built on-site, which is naturally a slow process.

Homes require land, and we can’t increase the supply of land in prime locations at all.

Unlike most products, once built, the supply of homes can’t be shipped where demand is highest.

When something can last 100 years, supply naturally increases extremely slowly.

House prices are extremely sensitive to increases in demand because the total supply of houses, naturally, increases extremely slowly.

Total Supply vs Supply FOR SALE

Home prices are determined by the supply of homes FOR SALE, not the total supply of homes that exists.

A large increase in new homes only increases the supply of homes FOR SALE a tiny bit.

In the 2000s boom, for example, the largest one-year increase in new U.S. single-family home completions was 11% in 2004, according to HUD data.

But only around 10% to 15% of U.S. homes sold are new homes.

That means a building boom as big as 2004 would only increase the supply of homes FOR SALE less than 2%.

When a building boom only increases the number of homes FOR SALE by less than 2% in a year, it doesn't take a huge increase in demand to cause house prices to skyrocket.

What Can Arizona Do?

Supply – End Government Policies that Decrease Supply

Fair Property Taxes. Make land owners pay taxes based on a property’s fair market value, like home owners do. It's crazy, for example, that according to the Maricopa County Assessor’s website, one 15-acre field in a prime location in Glendale paid $255 in property taxes in 2024 while just one house across the street paid $2,875.

Taxing land on its fair market value, like homes are taxed, is fair, and land owners would build homes sooner and increase the supply of houses faster.

Short-Term Rentals. Be aware that short-term rentals decreased the supply of homes far more than any supply increases from legalizing backyard casitas and ADUs.

Demand – End Government Policies that Increase Investor Demand

Federal tax policies are most of the problem, but state tax policies also increase investor demand.

To stabilize home prices and, therefore, increase home ownership, family wealth, and economic growth – on single-family homes and condos – Arizona could…

Get rid of the state mortgage interest tax deduction, at least on all future landlord mortgages.

Get rid of the state depreciation (and bonus depreciation) tax deduction, at least on all future home purchases.

Get rid of the state 1031 Exchange tax deferral immediately.

Tax profits when investors take out profits in cash-out refis.

Tax landlord profits and capital gains like ordinary income. Why should the landlord next door have a lower tax rate than you do?

Get rid of the stepped-up tax basis on inherited homes that weren’t the grantor’s primary residence.

Prohibit future purchases of single-family houses and condos by Limited Liability Companies. Arizona created LLCs in 1992, which reduced the liability of investors who owned single-family homes and condos. Investors have, naturally, bought a lot more homes since then. Is it fair that the landlord next door has less legal liability than you do? (Or increase taxes on these landlord LLCs to neutralize their advantages over live-in owners.)

GOAL

Get rid of ALL government incentives (taxes, laws, mortgage policies, etc.) to own single-family homes and condos unless they’re incentives for live-in home owners.

If we permanently end ALL government-created investor demand, the Arizona home ownership rate, family wealth, and economic growth will increase permanently for FREE.

https://esworld.substack.com/p/the-real-reason-your-dream-home-doesnt