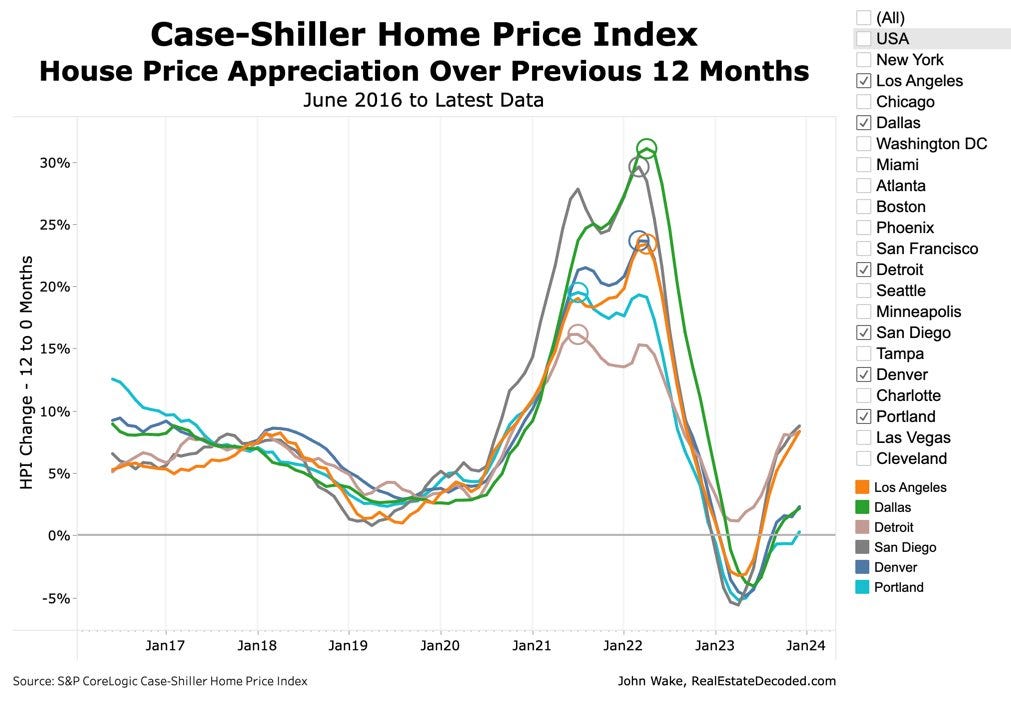

Prices were up 4% in 2022, too.

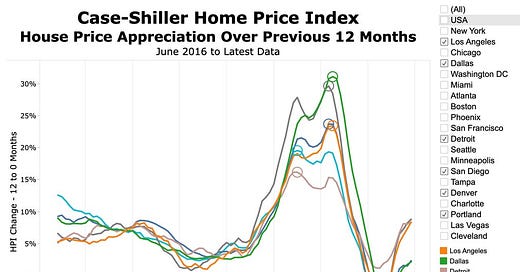

Top & Bottom Cities for 2023 Home Price Increases

Case-Shiller’s 20 Cities (nominal prices, not inflation-adjusted, real prices)

Top

9% - San Diego

8% - Los Angeles

8% - Detroit

Bottom

2% - Dallas

2% - Denver

0% - Portland

It’s not often that Los Angeles and Detroit real estate prices are in sync.

U.S. Real Mortgage Payment Price is 18% HIGHER Than 2006 Bubble Peak

2 Years Ago You Could Borrow Almost $100,000 MORE with a $1,000 Monthly Mortgage Payment

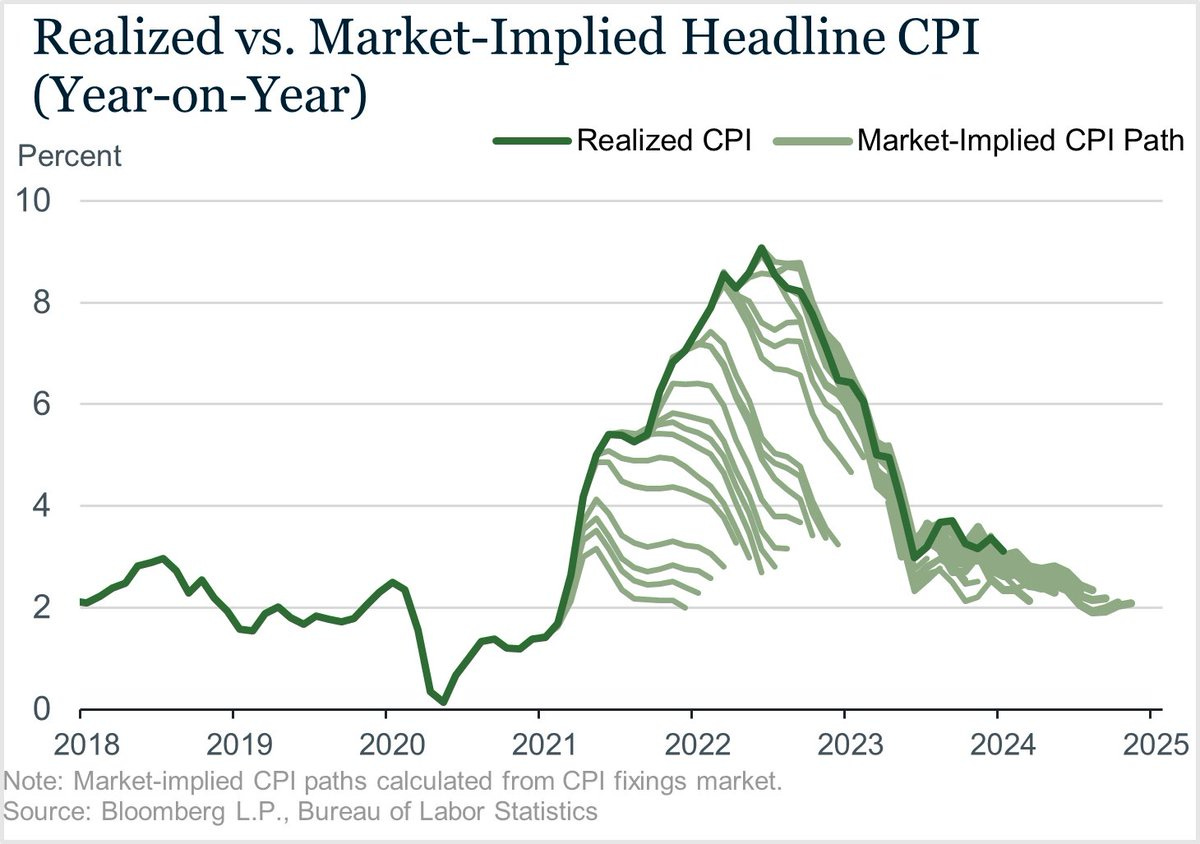

The Market Always Sees Lower Inflation Coming

Examining the Recent Inflation Episode, the Fed’s Response, and Effects on Markets

Looks like "transitory" inflation wasn't just the Fed's view.

Investors Bought 26% of the Country’s Most Affordable Homes in the Fourth Quarter —the Highest Share on Record - Redfin

A Little History (Real Estate Geeks Only!)

Mortgages in 1930

#1 – Savings and Loans (including building and loan associations, and mutual savings banks)

• 45% of all outstanding mortgages in 1930

• 40% average down payment (average, so often lower)

• 11 years average length (max 15 years)

• 95% partially or fully amortized (no balloon payment at end)

S&L interest rates were a bit higher and you had to have a long track record of saving with them before they would lend you money to buy a house.

#2 – Individuals (family, friends, individual investors and, especially, house sellers)

• 37% of all outstanding mortgages in 1930

• Average terms unknown

It was common for house sellers to be the “bank” for their house buyers. The buyer would pay a down payment, and for the rest of the money, the buyer and seller would negotiate a seller “carryback” mortgage.

Or, the buyer might use two mortgages. For example, the buyer might pay the seller 20% in a cash down payment, get a first mortgage for 50% from a regular lender, and borrow the last 30% directly from the seller in a second mortgage. Back then, second mortgages were widespread.

#3 – Banks

• 10% of all outstanding mortgages in 1930

• 47% average down payment

• 4 years average length

• 10% of bank mortgages were fully amortized (you owed nothing at the end)

• 39% of bank mortgages were partially amortized (you owed less at the end of the mortgage than at the beginning)

• 51% of bank mortgages (or 5% of all outstanding mortgages) were “straight” mortgages where you only paid interest until the end when you paid back the original amount you borrowed. Today, we would call these short-term, interest-only, balloon mortgages.

Refinancing was usually assumed to be certain and consecutive renewal of short-term mortgages was quite common... at least until the Great Depression hit.

Financing Home Ownership, Fisher, 1951.

Capital Formation in Residential Real Estate: Trends and Prospects, Grebler, Blank & Winnick, 1956.

Long-Term Changes in Cost and Terms of Mortgage Financing, Grebler, Blank & Winnick, 1956.

Thanks John. It's always great to see something from you.