Secret #11 – The Supply of Houses Grows More Slowly than the Supply of Gold

A key to understanding housing economics is to understand that housing is different from other goods because the total number of houses increases EXTREMELY slowly.

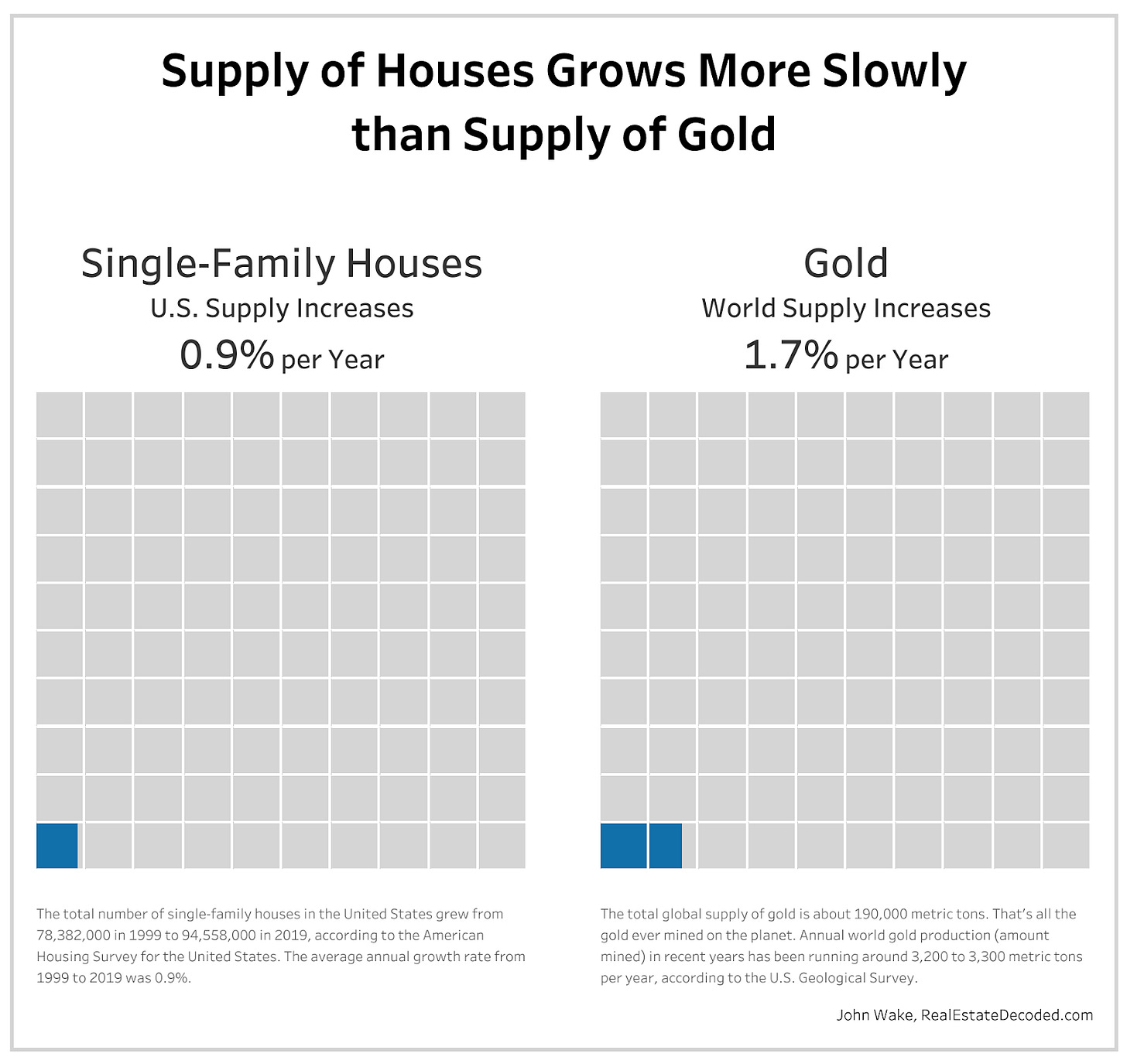

The total supply of single-family houses in the U.S. grows about half as fast as the total supply of gold in the world!

That's why house prices are extremely sensitive to increases in demand - the total supply of houses, naturally, increases extremely slowly.

It makes sense that the supply of something so large and so expensive that it can last more than a 100 years would increase incredibly slowly.

The second most expensive purchase in a lifetime is usually cars but cars are about 1/10th the cost of a house and cars can be built far away in mega-factories designed for super efficient production while houses have to be built on their final site, which is naturally slow and expensive.

With such an incredibly slow growing supply, house prices are incredibly sensitive to any increases in demand from anywhere, including from landlords jumping into the market. It doesn't matter to house prices why the landlords jump in. All that matters is that more money is chasing houses.

The demand from live-in owners is far more stable, it’s tied to population and income which increase very slowly and better matches the very slow increases in total housing supply.

Even during booms, the demand from live-in owners can’t increase very fast. Some people may buy their first homes at a younger age during booms but they still only buy one house to live in.

When landlords jump in, they buy more than the one house they live in, sometimes a lot more houses, so landlord demand can jump a lot more than demand from live-in owners.

The stock of houses is fixed in the short and medium run.