Secret #52 – Housing Bubbles are Common Historically

Houses are naturally prone to bubbles due to their naturally SLOW growing supply. When demand increases faster than supply – for any reason – bubbles can happen.

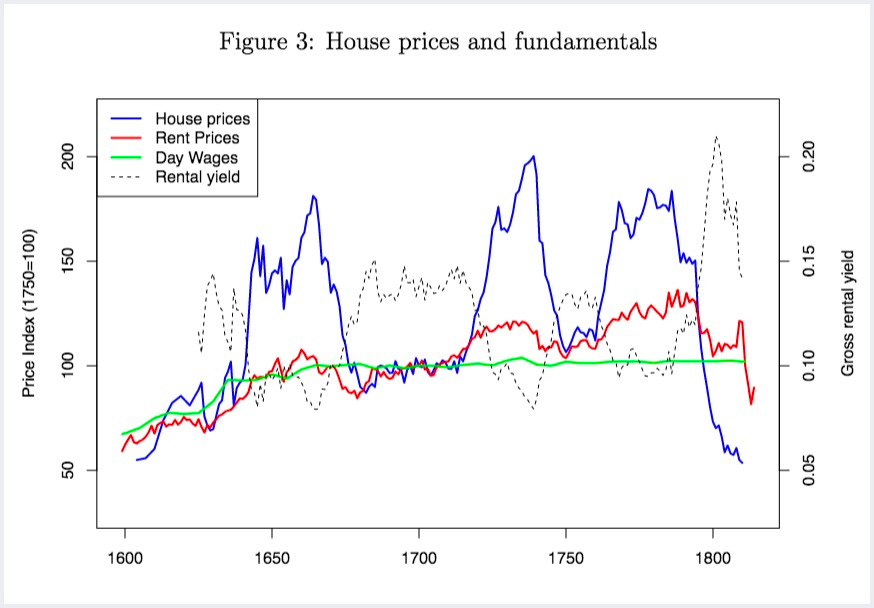

200 Years Of Amsterdam Housing Bubbles

Amsterdam had three large real estate bubbles from 1582 to 1810. The real estate market was entirely different 200-400 years ago in Amsterdam but those Amsterdam bubbles shared at least two similarities with modern real estate bubbles.

An initial shift toward investing in real estate (caused by outside forces), which increased house prices, and;

The higher prices triggered additional purchases justified by those past house price increases, which in turn caused additional price increases and additional purchases, and so on until house prices were completely out of whack.

Changes in mortgages was NOT one of the similarities with modern bubbles because mortgages were uncommon in Amsterdam back then. Credit booms are NOT necessary for real estate booms but an increase in the amount of money chasing houses is necessary.

Whether the increase is caused by 18th-century Dutch investors shifting money into real estate from other investments, or crazy 21st-century American mortgage companies lending to anyone with a pulse, it doesn’t matter to house prices why there’s more money chasing houses, it only matters that there’s more money chasing houses.

When enough of these new investors buy enough real estate, those additional sales will cause prices to (eventually) increase, which will again motivate investors, new and old, to buy more real estate, which will cause prices to increase even more and so on in a self-reinforcing upward price spiral.

The larger and longer the price increases, the more potential buyers are confident prices will continue to increase after they buy. More and more buyers focus on the potential profits from price appreciation when they sell rather than the ongoing rental income.

The Amsterdam study found significant price momentum effects, that is, that higher prices – in and of themselves – can cause additional higher prices. That is, house price increases were explained, in part, by house price increases the previous year. Surprisingly, the study found house price increases were explained even more by house price increases TWO years earlier!

It seems when house prices have increased for the previous two years, some potential house buyers feel confident enough that the upward price trend will continue that it’s safe for them to pull the trigger and buy investment houses – no matter how high prices are at the time. They’re keying on the past increase in prices, not current price levels or the economic fundamentals.

Notice the peak of the second bubble was short-lived before prices started to crash but in the third bubble prices were near peak levels for more than 2 decades before crashing.

Bubble Economics

One definition of a bubble says when higher prices make people want to buy more – not less – of something, it’s a bubble.

Bubbles break the fundamental rule of economics that says people will buy less of anything when its price increases. Apparently, current demand isn’t just based on current prices but also on what people expect future prices to be, especially for investment goods.

In a market like houses where supply increases incredibly slowly, and only a very small percentage of houses are bought and sold in a year, that means a very small increase in the percentage of people who are convinced house prices will increase a lot in the future can, in and of itself, drive up prices for all houses.

Despite all the differences between the real estate markets in Amsterdam 200-300 years ago and in the United States 20 years ago, studies of both have found a big determinant of price increases was the price increases the previous two or three years.

I wonder if this is a basic human trait – it takes a year or two or three for people to believe past house price increases (or decreases) will continue. Their view of the future is just a reflection of the recent past.

Here's a quick review of 3 U.S. real estate bubbles; New York in the 1790s, Chicago in the 1830s, and Los Angeles in the 1880s.