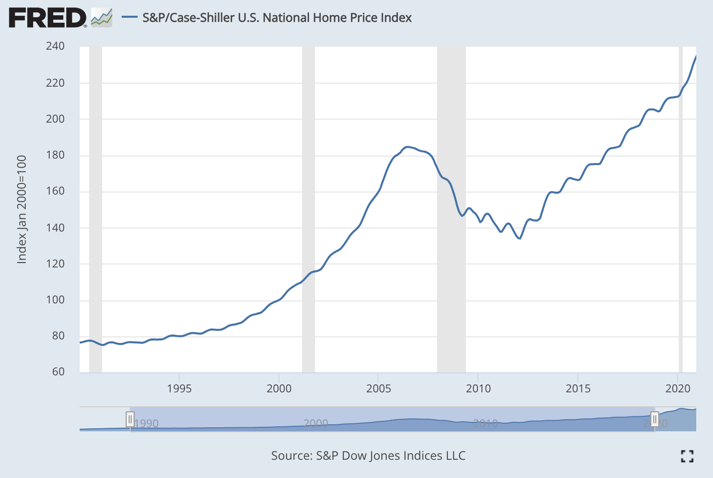

Secret #56 – About 80% of House Price Appreciation from 1990 through 2020 was Due to Falling Mortgage Interest Rates

U.S. house prices tripled from 1990 through 2020. On average, a house worth $100,000 in January 1990 would have been worth about $300,000 in December 2020.

Although house prices appreciated 200%, monthly P&I payments only increased 41% due to the lower interest rates.

1990. The P&I payment on $100,000 at 9.9% interest would be $870 per month.

2020. The P&I payment on $300,000 at 2.7% interest would be $1,227 per month.

A $1,227 monthly P&I mortgage payment in 2020 could buy a $300,000 house but only a $141,000 housing in 1990.

1990. A $1,227 monthly P&I mortgage payment at 9.9% interest could buy a $141,000 house.

2020. A $1,227 monthly P&I mortgage payment at 2.7% interest could buy a $300,000 house (in this simplified example without down payments).

That suggests if interest rates hadn’t fallen (but the monthly P&I mortgage payment stayed the same) that house prices would have only increased around 40% from January 1990 to December 2020. The rest of the 200% increase in house values was due to falling interest rates.

This quick analysis suggests that as much as 80% of the house price appreciation from 1990 to 2020 was due to falling interest rates.

Without falling rates, home ownership would have created 80% less wealth.

For example, if you bought a house in 1990 for $100,000 and paid off the mortgage in 2020, you gained $100,000 in wealth by paying off the mortgage and $200,000 in wealth due to the appreciation.

If, however, mortgage rates had never fallen you would have gained $100,000 in wealth by paying off the mortgage and only around $40,000 in wealth due to appreciation, according to this quick analysis.

What happens to house price appreciation over the next 30 years if it turns out interest rates bottomed out in 2021?