Secret #66 – The Housing Wealth Effect is a Double-Edged, Lopsided Sword

When house prices go up $1, home owners spend 2 cents more in the economy but when house prices go down $1, home owners spend 4 cents less in the economy. At least that’s an estimate of the housing wealth effect in New Zealand.

For the U.S., former Fed chairman Bernanke said in 2012 that when house prices go down $1, home owners spend between 3 to 5 cents less per year.

Erratic house prices are bad for the economy. When house prices unexpectedly increase to unsustainably high levels, home owners tend to feel richer, save less money, and spend more money than they would otherwise. Those skyrocketing house prices are great for the economy … for a while.

But then when house prices fall, home owners tend to save more and spend less than they did before the boom.

Due to the housing wealth effect, the economy shrinks more during the bust than it grew during the boom.

The economy ratchets down and, overall, home owners end up with less wealth when house prices jump up and jump down.

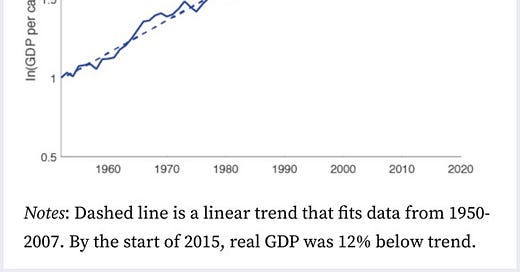

Unlike normal recessions, there was no quick economic rebound following the Great Recession due to the housing wealth effect. The 2000s housing bust turned the 2000s recession into the Great Recession. GDP per capita didn’t rebound as usual and GDP ran 12% below trend for years.