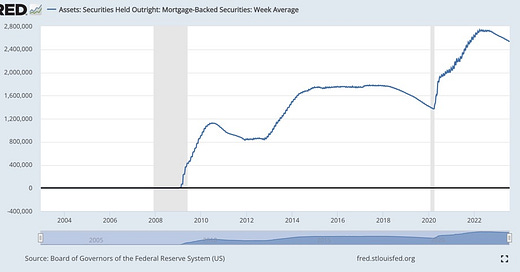

Secret #7 – For the Money the Fed Spent Buying Mortgage-Backed Securities from 2009 to 2015, We Could Have Bought ALL Houses Foreclosed On from 2006 to 2013

The Fed owned $1.75 trillion of mortgage-backed securities by 2015 trying to keep mortgage rates down and house prices up. For the same amount of money, however, we could have bought every single house foreclosed on during the Great Real Estate Bubble.

That is, we could have bought directly from the banks all 7 million completed foreclosures from 2006 to 2013 for that $1.75 trillion (and turned them into rentals until the market strengthened). That would have stopped house prices from crashing as much as they did and that, in turn, would have lowered the number of foreclosures and the number of Americans devastated by foreclosures.

That estimate assumes the foreclosures were bought at peak 2006 home prices, about $250,000 per house. In reality, foreclosures sell for far less than the original purchase price so the government could have bought all 7 million foreclosures for far less than the $1.75 trillion of MBS the Fed owned in 2015.