Secret #73 – Did the Internet Make the Real Estate Market LESS Rational!

Contrary to the theory of rational expectations, it appears the explosion of online real estate information made the real estate market less rational. Certainly, it seems to have made house prices even less stable.

In 2005, I thought people and markets were inherently rational and if we just had more real-time information about what was really happening in the market, the market would act more rationally, more predictably, without all the wild booms and busts. Lack of information was the problem, I thought.

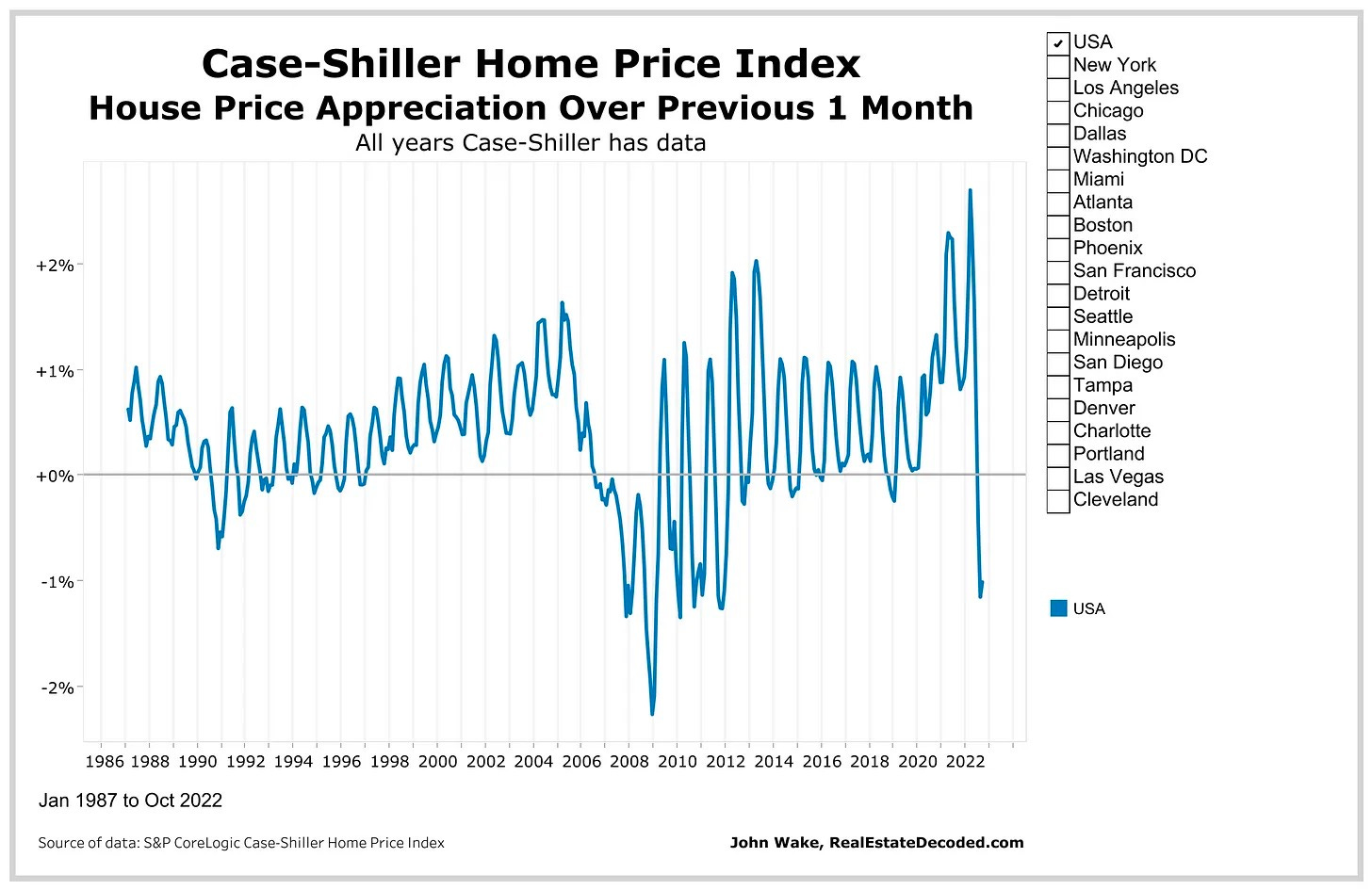

Today, the market has a ton more information than in 2005 but the real estate market in recent years has been MORE unstable with steeper price increases and steeper price decreases than in the 2000s.

It appears that more information also feeds some of the “irrational” human economic quirks that behavioral economists are always talking about. It appears that after losing out on a few bidding wars some buyers want to win at any price. It’s a bit of unintentional gamification of the house-buying process.

It appears likely house prices will forever be more sensitive to increases in demand and the real estate market will forever be more prone to booms and busts.

It may be markets are about as rational and irrational as people in general. People make mistakes and sometimes markets make mistakes too because they’re only human.

Perhaps, I was being irrational back then when I thought markets were rational and the only problem was the lack of timely data on what was happening in the real estate market.