As usual, presidential candidates want new tax breaks for home buyers to increase affordability and home ownership.

That never works. They should do the exact opposite and end the old tax breaks landlords get on single-family homes and condos.

Sure, new tax breaks for first-home buyers work temporarily but they eventually lead to higher home prices so all later home buyers are worse off. Economists say those tax breaks get “monetized” or “capitalized” into higher home prices. The tax breaks don't increase home ownership in the long run.

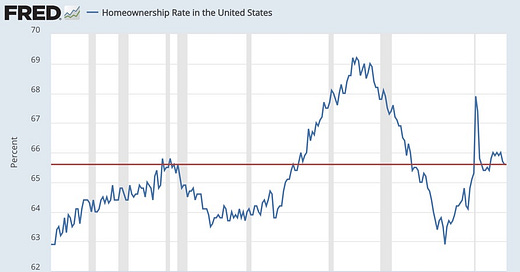

For example, despite all the “affordable” housing programs we've had over the last half-century, the U.S. home ownership rate is about the same as it was 50 years ago! And the gap between the White and Black home ownership rate is about as big as it was 50 years ago!

If we're going to change the tax code, let's do it the right way.

A free, surefire, quicker, easier, much larger, and permanent way to increase home ownership is to do the exact opposite of adding tax breaks for first-home buyers because they just increase demand and then home prices. The solution is to REMOVE the tax breaks LANDLORDS get on single-family homes and condos purchased in the future which would permanently reduce and stabilize future demand and future home prices, all without increasing government spending.

The zillion tax breaks we give investors essentially pay investors to buy homes away from owners who would live in those homes. The tax breaks also increase home prices and that also lowers home ownership (and U.S. economic growth).

The dumbest tax break we give investors of single-family homes and condos is the depreciation tax deduction. Even if a rental house appreciates $100,000 in a year, the landlord still gets a tax deduction for imaginary depreciation. Investors get a lot of other tax breaks including the 1031 Exchange and the mortgage interest tax deduction.

Most owners who live in their homes do not get the mortgage interest tax deduction because they take the standard deduction instead. However, all landlords can take the mortgage interest tax deduction on all their mortgages on all their investment properties. It doesn't have to be that way. According to a 2022 OECD study, in some countries, including France, Germany, and Italy, mortgage interest is not a tax deduction for landlords.

Removing all investor tax breaks on all future purchases of single-family homes and condos in the U.S. would significantly increase home ownership at no cost to the government.

And unlike most government policies, this policy would be easy to manage after it’s implemented. We don’t have to depend on government bureaucrats making the right decisions after it’s implemented. The government doesn’t have to do anything except keep those investor tax breaks out of the tax code.

And the benefits to home ownership and housing affordability will be permanent if the tax breaks are removed permanently.

Increasing the supply of homes is a great idea but let’s not forget a free, surefire, quicker, easier, much larger, and permanent way to make housing more affordable; lowering government-induced investor demand. The demand from investors to buy and own single-family homes and condos is, to a large degree, driven by the tax code, not the free market.

The big mystery is why such a completely obvious solution is completely invisible to politicians.

If you think this option should be discussed, please talk about it in your social media. Thanks! -John

Brilliant! This is genius John! Definitely would fix the investors dominating the bids in Bay Area.