[An earlier version of this piece appeared in Forbes.com.]

The U.S. is a mortgage-ownership society, not a home-ownership society.

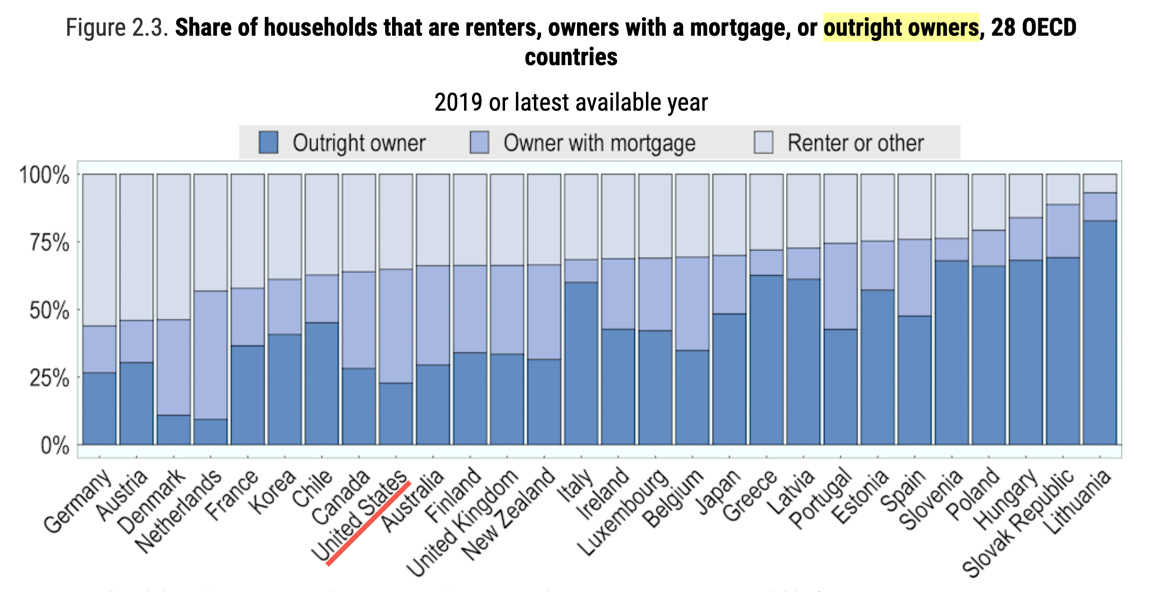

A 2022 OECD study of 28 countries found the U.S. had the 3rd lowest percentage of households that owned their homes “free and clear” with no mortgages, as “outright owners.”

Source: OECD (2022), Housing Taxation in OECD Countries, OECD Tax Policy Studies, No. 29, OECD Publishing, Paris. Graphic annotated by John Wake.

Free and Clear = No Mortgage

In the U.S., “free and clear” usually refers to home owners that own their homes without mortgages. This study looked at the percentage of ALL households – not the percentage of home owners – that were free-and-clear home owners.

What determines a country’s free-and-clear home ownership rate? It’s a fascinating question.

Long Mortgages

The three countries in the study with the lowest free-and-clear home ownership rates were the U.S., Denmark, and the Netherlands. One reason for the low rates would certainly be the length of the typical mortgages in those countries.

van Hoenselaar, F., et al. (2021), "Mortgage finance across OECD countries", OECD Economics Department Working Papers, No. 1693, OECD Publishing, Paris. Chart annotated by John Wake.

Like in the U.S., the typical mortgage is 30 years in Denmark, and about 28 years in the Netherlands, according to another OECD study. In 80% of the countries in that study the typical mortgage maturity was less than 30 years. More countries had 20-year mortgages than 30-year mortgages.

People, of course, pay off their mortgages and own their homes free and clear with not debt many years earlier in countries where mortgages are shorter.

Tax Breaks

Home owners in Denmark and the Netherlands get extremely large mortgage interest and other tax breaks on the homes they live in.

OECD (2021), Brick by Brick: Building Better Housing Policies, OECD Publishing, Paris. Chart annotated by John Wake.

When the government essentially pays you to have a mortgage, people pay off their mortgages much more slowly. The tax breaks are so large in the Netherlands that 40% of their outstanding mortgages were interest-only mortgages. Those Dutch home owners are not paying down their mortgage debt at all.

In the U.S., the mortgage interest tax breaks on primary residences are not nearly as large as in the Netherlands or Denmark but, combined with large U.S. tax breaks for landlords which tend to crowd out and price out primary home owners, our tax breaks may help explain some of the surprisingly low free-and-clear home ownership rates in the U.S.

Other Reasons

Countries with high levels of home equity withdrawals (HELOCs, cash-out refis, and adding second mortgages) would see delayed free-and-clear home ownership.

In countries where 30-year fixed-rate mortgages dominate, when interest rates fall, many home owners will refinance into new 30-year mortgages even though they had less than 30 years left on their old mortgages. Free-and-clear home ownership is delayed.

Another factor could be smaller down payments. Smaller down payments can lead to more expensive homes which take longer to pay off.

Central and Eastern Europe

You might have noticed that the countries that have the highest free-and-clear home ownership rates tend to be in Central and Eastern Europe.

Post socialism most of those countries, “implemented some form of ‘giveaway’ privatization, with sitting tenants often paying as little as 15 percent of the market price of the dwelling they inhabited,” according to research from the Metropolitan Research Institute. The 2017 report adds, “some 75-95 percent of national public housing stocks have been sold to sitting tenants under ‘giveaway’ financial conditions.”

Italy and France

Each country has a unique mix of policies that influence their free-and-clear home ownership rate. Italy and France are more typical of southern and western Europe.

In Italy, in 2005 anyway, the typical mortgage was 22 years long, the minimum down payment was 20%, mortgage interest was tax deductible and, according to the first OECD study mentioned above, 60% of all households owned their homes free and clear (versus 23% in the U.S.).

In France, using the same datasets, the typical mortgage was 20 years long, the minimum down payment was 0%, mortgage interest was not tax deductible, and 37% of all households owned their homes free and clear (versus 23% in the U.S.).

The American Dream

The country with the highest free-and-clear home ownership rate in the list above was Lithuania at 83%. In the U.S., the free-and-clear home ownership rate was 23%.

If free-and-clear home ownership is the American Dream, then apparently Lithuania and many other countries are living the American Dream.

Total U.S. Home Ownership

The U.S. had the 2nd highest percentage of households that owned their homes but still had mortgages. All that U.S. mortgage debt, however, hasn’t increased total U.S. home ownership much.

Looking at all home owners, whether they have mortgages or not, the overall household home ownership rate was higher in 19 of the 28 countries shown above than in the U.S.

It certainly seems U.S. housing policy is designed to maximize mortgage-ownership, not home-ownership.

For another more detailed list of free-and-clear home ownership rates in 42 countries, see this page on the OECD website.

Very interesting, John!