The Volatility Mismatch Theory of Housing Supply and Demand, and House Price Instability

Why House Prices Skyrocket

[An earlier version of this piece appeared in Forbes.com.]

The conventional wisdom in recent years has become that skyrocketing house prices are only caused by the low supply of houses for sale, and the low supply of houses for sale is only caused by residential zoning, NIMBYs, and local government inefficiency. There’s some truth to all of that but a far, far bigger reason house prices have skyrocketed is the supply of houses increases extremely slowly, by nature, and supply can’t keep up with any fast changes in the demand for houses.

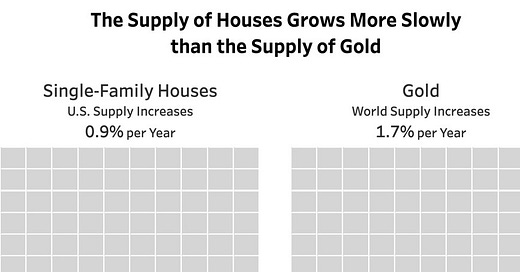

People think gold is the quintessential example of a product where supply grows extremely slowly, but the total number of single-family houses in the U.S. grows much more slowly than the total supply of gold worldwide. In fact, the supply of gold grows almost twice as fast (1.7% per year) as the supply of single-family houses in the United States (0.9% per year)

The reason house prices skyrocket is this mismatch between how fast supply can change and how fast demand can change. The demand for houses can rise – and fall – a lot faster than the supply.

It doesn’t take large increases in the demand for houses to outrun the naturally extremely slow and steady increases in the total supply of houses, and when that happens, prices can skyrocket.

Supply: Total

It makes sense that the largest thing, by far, that the typical American buys would also take a long time to build and would take a long time to scale up production. Demand for houses can jump up a lot faster than construction can be cranked up.

Naturally Low Production. Part of it is because houses can last 100 years or more, so fewer need to be built each year compared to most other products. The industry naturally has very low production relative to the total number of houses in existence so it takes a long time to significantly increase the total number of houses in existence.

Completely Immobile. To make matters worse, you can’t import houses from Germany or Japan, or from the state next door. Unlike gold and most other products, you can’t just import more houses to increase supply when your local demand increases.

Further, each house is immobile locally, too. Houses that are twice as far from your work aren’t great substitutes for houses closer to work, even if the houses are otherwise identical. The supply of houses that meet your location and other criteria may be few and may not be increasing much in numbers even if a lot of new houses are going up in the new subdivisions on the edge of town.

The supply of houses is only increasing about half as fast as gold but then when you add in that houses are completely immobile, it’s clear the supply of houses naturally increases far more slowly than the supply of gold.

Supply: For Sale

But it gets worse. When it comes to prices, the supply of houses for sale is more important than the total supply of houses that exist. Almost everyone agrees the cause of the skyrocketing house prices since 2020 has been the low number of houses for sale.

The best-case scenario for new house construction would probably be 2002 to 2005 when we saw a boom in the number of new single-family, privately-owned housing units built.

That boom in new construction saw four years of increases averaging 7% per year. The highest increase in new construction nationally was in 2004, which saw an 11% increase over 2003. Let’s assume an 11% increase in one year is the maximum increase in new construction we can realistically expect.

How much would an 11% increase in new construction increase the number of houses for sale?

Most houses sold are not new, they’re used. Only 11% of single-family houses sold in 2021 were new construction, according to an analysis of data from Redfin, a national real estate brokerage.

That means if new house construction increased by our estimated maximum (11% in one year), and new houses only made up 11% of all houses sold, then that maximum increase in new construction would only increase the number of houses for sale by about 1.2% (11% x 11%).

When a construction boom can only increase the number of houses for sale by 1.2% it doesn’t take large increases in demand to eclipse that additional supply and for house prices to rocket.

To make matters worse, some home builders might rationally decide to slow down production – or at least, slow down sales – when house prices are increasing fast in order to increase sales in the future when expected prices and profits will be higher.

Elastic Is Inelastic

Even historically large increases in supply can easily be overrun by increases in demand. For example, Phoenix had a reputation as being an easy place to build new houses. Economists said it had “elastic” supply. And, indeed, Phoenix new house construction boomed during the real estate boom of the 2000s. Despite years of rapidly increasing production, in 2005, Phoenix home builders still had so much unsatisfied demand that some builders held lotteries to see which prospective buyers they would sell their new houses to!

Although home builders were not even close to meeting demand in 2005, Phoenix home builders would later be blamed for overbuilding in 2005! As demand fell from the peak, home builders couldn’t cut their production pipeline as fast as demand fell. The supply of houses for sale skyrocketed and prices tanked. For example, existing single-family house prices fell more than 50% in metro Phoenix from the top of the boom in 2006 to the bottom of the bust in 2011.

Demand moved far faster than supply on both the upside and the downside of the cycle. Having an unusually elastic supply didn’t protect Phoenix. A metro known for its new home construction had one of the biggest booms and biggest busts in the entire country because of the big mismatch between housing supply volatility and housing demand volatility.

Live-In Owner Demand

Now, usually, the incredibly slowly increasing supply of housing isn’t a problem because the demand from people to buy houses to live in also increases incredibly slowly. The growth in that demand depends largely on population growth and income growth, both of which also change extremely slowly from year to year, so new construction can usually keep up with those slow increases in demand.

But unlike the demand from live-in owners (also known as, primary-home owners, and principal residence owners), the demand from investors can be very volatile. Landlord owners can jump into the market quickly. But they can also jump out of the market much more quickly than live-in owners because investors don’t have to move their families when they sell a rental house. And if you sell the house you live in because prices are higher, you’ll just have to buy another house to live in at those higher prices. Higher house prices don’t really help live-in home owners unless they plan to sell and not buy another house.

Demand from landlords can increase (or decrease) far faster than supply can increase (or decrease), and that mismatch can cause house prices to spike (or tank).

Landlord Owner Demand

One of the biggest differences with housing economics is that houses are partly a consumption good and partly an investment good. For live-in owners, houses are mainly a consumption good (a place to live) but for investors, houses are 100% an investment good. Second homes are in between.

When prices of consumption goods increase, sales are supposed to fall. We often don’t see that with houses, at least in the short and medium-term, because houses are also an investment good.

That means when house prices are going up fast – and investors think they’ll continue increasing – houses look like a better investment, and many investors become less likely to sell, and more likely to buy, the opposite of what happens with consumption goods.

Cash Flow and Appreciation. Houses are just one of many investments that investors can jump into and out of. Investors can jump into buying houses for a lot of reasons including, of course, when they think houses will be more profitable in the future.

Diversification. But investors can also jump in for reasons that have nothing to do with changes in the housing market itself. For example, in the last year, some investors in the skyrocketing stock market wanted to diversify so they took some money out of the stock market and invested it in single-family houses.

The Internet. With all the information available, it’s become easy for large institutional investors to dive into single-family houses, something they didn’t do before 2010.

Inflation Higher Than Interest Rates. Recently, an additional factor was interest rates being lower than inflation which made it seem wise to borrow as much money as possible to buy houses.

Price Expectations Feedback Loop. As mentioned, a HUGE factor that is usually ignored is investor expectations of future house prices. When the price of anything increases significantly for a certain amount of time, many people will expect its price to continue increasing. When that happens it doesn’t matter how high you think the price is, if you expect the price to go higher, it’s rational to buy.

You sometimes see this price behavior with individual stocks. But we also sometimes see it with other investments like houses. With investment goods, higher prices themselves can sometimes lead to higher prices in a feedback loop.

For investors, houses are 100% an investment good. Higher prices can increase the demand to own houses from investors who expect prices to continue increasing. For non-investment goods, higher prices decrease demand.

Profit-Taking Without Selling. Similarly, if they want to, real estate investors are more able to buy more houses after prices increase! Unlike with stocks, it’s common for investors in houses to take some profits out of their houses without having to actually sell their rental houses and increase the supply of houses. If the value of an investment house increases by $100,000, they can just do a cash-out refinance or add a second mortgage, and pull some money out tax-free. In addition, the interest payments on their new cash-out mortgages are tax-deductible. Many of those investors will use the cash-out money from the refinance as down payments to buy even more investment houses.

By the way, most live-in owners with mortgages don’t take mortgage interest tax deductions. I assume almost all investors with mortgages do.

Investors in Houses Can Borrow a LOT More Money. Investors in single-family houses can also borrow a lot more money than stock investors which can make investing in houses a lot more profitable.

If an investor invests $1 in stocks, the investor might be able to borrow up to another $1 to buy more stocks (at a high interest rate). But if an investor invests $1 in houses, the investor might be able to borrow another $3 to buy houses (at a low interest rate). With $1 to invest, the investor can own $2 worth of stocks or $4 worth of houses.

If prices go up by the same percentage, the investor makes twice as much money on their investments in houses. In addition, the government will essentially pay part of the landlord’s $3 mortgage with the mortgage interest tax deduction. Higher leverage means higher profits in a bull market and is one reason why some investors shift money into real estate.

In addition, highly leveraged investments like houses do better when interest rates fall compared to investments with less leverage. That makes the demand for houses even more sensitive to interest rates.

Interest Rates. A lot of things will pump up demand for houses but the largest one is falling interest rates. Falling mortgage interest rates have a big impact on monthly payments which pumps up sales, which pumps up prices, and which can start or reinforce a “higher prices lead to higher prices” feedback loop.

Fast falling mortgage interest rates boost demand far faster than supply can possibly increase.

Lower interest rates have a huge impact on demand from both investors and live-in owners.

Huge Mismatch Between Supply And Demand Volatility

It would be nice if we could crank up house construction more quickly when demand increases quickly but that’s just not the way the world works. It would also be nice if we could grow a crop of wheat in one month but that’s just not the way the world works, either.

We need to be realistic. The supply of houses grows incredibly slowly, naturally, and new houses only make up a small percentage of the number of houses for sale, so increases in new construction only have a tiny impact on increasing the number of houses for sale, at least in the short and medium-term.

We have a huge mismatch between how fast the total supply of houses can increase and how fast the total demand for houses can – and often does – increase. That mismatch can cause house prices to skyrocket.

On the other end, we saw after 2006, a huge mismatch between how fast the total demand for houses can fall, and how fast new house construction can fall. That led to sharp increases in the supply of houses for sale, and then sharp decreases in house prices.

With the supply of houses growing more slowly than the supply of gold, real estate is naturally prone to booms and busts. We should try to remove man-made barriers to increasing housing supply but, realistically, supply will never be able to increase nearly as fast as demand can, especially, investor demand. And we don’t want to increase the total supply of houses based on short-term increases in demand from investors, anyway.

Solutions

We don’t have any policy tools that can increase housing supply very quickly but we can easily make it so demand increases more steadily and doesn’t jump around as much.

To reduce investor speculation, some countries have put large speculation taxes on landlord profits if they sell, for example, within 10 years of buying the house.

Before we consider increasing taxes on investors of single-family houses in the United States, however, we should first try leveling the playing field and stop giving any tax breaks at all to landlords that live-in owners don’t get. Everyone gets tax breaks on the one house they live in and own, but zero tax breaks on any other houses they own. We would have one tax code instead of two completely different tax codes for single-family houses fighting against each other.

Landlord tax breaks are a top reason people invest in single-family houses instead of investing their money elsewhere. There’s a minor industry in explaining all the tax breaks landlords get.

Investors would still be buying and selling single-family houses but without all the tax breaks, they would be buying fewer. It’s a way we can stabilize house prices without reducing sales to live-in owners. In fact, we would increase the home ownership rate if we stopped subsidizing investors buying single-family houses.

Because of the landlord tax breaks, landlords make more money and buy more houses, and that drives up overall demand and house prices because supply increases so slowly. That boost from investors in baseline demand makes house prices more sensitive to any additional increases in demand even if investor demand isn’t increasing.

When the market gets hot for any reason, it gets even hotter than it would otherwise because demand started out at a higher point because of all of our government incentives encouraging landlords to buy single-family houses. It doesn’t matter if the increase in demand comes from deregulating Savings and Loans, from an explosion in non-prime mortgages, or from the Fed lowering interest rates steeply for two straight years, prices increase more when demand increases when demand is higher to start with.

Too many houses are bought as tax shelters for investors instead of as homes and shelters for people.

If removing landlord tax breaks doesn’t stabilize house prices enough, we have a ton of additional options. We could always copy the anti-speculation taxes and the other measures other countries use to discourage investors from unintentionally destabilizing their housing markets, home ownership rates, family wealth, and national economies.

The Future

The current conventional wisdom in the real estate industry treats supply like a magic wand that will solve the problem of high house prices and everything else wrong with the housing market. That’s convenient because it diverts attention away from a much bigger problem, but one we can easily reduce, investors jumping into the market for single-family houses and crowding out live-in buyers.

No matter how hot the market, the real estate industry is, naturally, against anything that would reduce demand, house sales, and their profits, even if the measures would also reduce the number and size of future real estate busts.

The industry doesn’t think that far ahead. That’s not their job. Their job is to sell as many houses as possible this month. They’re just playing by the rules of the game but, whether the market is hot or cold, they always want the rules to favor more demand and more sales now, regardless of the longer-term impacts.

The industry supports efforts like the Biden Administration’s new Housing Supply Action Plan, in part, because it makes small improvements that distract attention away from a huge problem we can easily fix, all the government incentives for big and small investors that crowd out live-in owners and destabilize house prices.

Hopefully, our politicians will someday do their jobs and level the playing field for live-in owners. If the U.S. government would stop distorting the housing market, we would increase home ownership, economic growth, economic equality, and household wealth creation.

If our politicians don’t stabilize house prices, there’s a real risk of increased political instability in the future. What happens politically if house prices fall even half as much as they did during the Great Recession, or if house prices continue increasing even half as fast as they did during the last two years?

Notes

U.S. Single-Family House Supply. In the top graph, the 0.943% annual growth rate in the total supply of U.S. single-family houses from 1999 to 2019 was derived from the American Housing Survey for the United States for 1999 (78.382M units) and 2019 (94.558M units). Those 20 years included a major boom as well as a major bust in new house construction.

Global Gold Supply. The 1.72% estimate of the annual increase in total global gold supply was derived from U.S. Geological Survey data for 2018, 2019, and 2020 (an annual average increase of 3,210 metric tons). The estimate of the total global supply of gold came from this U.S. Geological Survey publication, “As of yearend 2017, global estimated historical gold mine production has totaled about 190,000 metric tons (t) of gold. Because gold has been nearly 100% recycled and is resistant to corrosion and oxidation, about 98% of the gold that has been produced throughout history is still available.” Therefore, the average annual increase in the global supply of gold for the years 2018 to 2020 was 1.72% (3,210/(190,000*0.98)).

John, great article, but what happens to rental housing costs and what happens to renters if the cost of owning and then renting a house costs more to the landlord, most likely to be past on the tenants. Where are the stats about how much builders are taxed to start a home?? About 35% of people rent. They are benefiting from the "tax breaks" the landlords are getting as well. Other wise landlords would put the investment to work in something else..and rents would skyrocket.

John, this one so really good!

An area to expand on in future discussions might be how demand for housing was impacted Covid.

Many homeowners increased their demand for space (whether to work from home, or to host at-home schooling). This generated an outlier spike in demand for the amount of housing.

Further, adding to the point you already made, demand for increased space was in different locations from where people had envisioned living in 2019.

Those locations (think suburbs, or Mountain States) had little pending new supply in the pipeline when Covid hit. Remote work further changed the rules on where people might live.

The key questions going forward are: 1) are those lifestyle changes permanent (even if Covid were to disappear), and 2) how long will it take to generate supply for those new locations.

My sense is that the HPA for 2020-21 represents a surge due to an immediate change in preferences, combined with a slow change in supply, but that as supply comes to new areas (at the same time interest rates are increasing) HPA will temper off toward longer-term trends.